This post discloses the next batch of PowerRatings for the 7/12 and comments on the results of yesterday’s PRs: (more…)

July 2006

Tue 11 Jul 2006

Tue 11 Jul 2006

Has anyone else noticed the difference lately in the Nasdaq Composite ($IXIC or $COMPQ depending on the source) and the Nasdaq 100 ($NDX – tracked by the ETF QQQQ)?

The composite is making higher lows since mid-June, but the Nasdaq 100 is testing its lows for the year today. The news (CNN, NPR, CNBC, etc.) all seem to quote the composite index instead of the NDX, even though the NDX index is more heavily traded (via NDX options and QQQQ). (more…)

Tue 11 Jul 2006

I just ran across a horribly wrong search result, only to find a stock symbol with the most amusing company name I’ve seen in a while. The stock symbol WYDY is for “Who’s Your Daddy Inc“, purveyor of energy drinks by the same name.

Don’t bother considering it though, it’s market cap is an amazingly small $9.5 million dollars (yes million with an “M”). With revenue of $250k and a current cash position of $1,000 (wait… I have more cash than that in my bank account!) it’s amazing that they even went public at all.

You’ll find the shares trading over the counter as they can’t even stay above $1/share to stay listed on the Nasdaq.

Tue 11 Jul 2006

Here’s stocks with a PR of 9 today: NTG, ILE, IDCC (down 21% yesterday!), FSII, ENZ, DXPE, COGO, ASPV

Here’s stocks with a PR of 1 today: AD, GGXY, LSCP, SBIT

Note that COGO (down 5.72% yesterday) and ASPV (down 5.00% yesterday) were rated 9’s yesterday, so these are worth watching since they’ve been 9’s for 2 subsequent days.

FMD had a PR of 9 on 7/7, 7/10 and currently has a PR of 8 today 7/11. Just check out it’s 5 day chart to see just how bland it’s been…although it could be argued that it’s just a coiled spring. Quicksilver, do you see a chart pattern in FMD?

Mon 10 Jul 2006

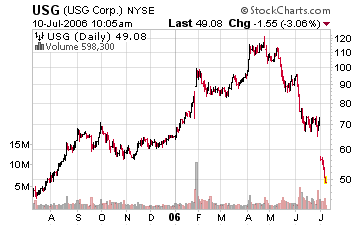

Thought I’d point you guys to a rather harrowing chart:

USG, the producer of wallboard materials and much more, has practically been in a free-fall the last few months. It was practically a rocket on the way up as it fought past a ton of negative asbestos litigation and is about to emerge from bankruptcy.

I typically wouldn’t care, but I recently sold USG because it hit my trailing stop (when it was at 95!). If you ever needed an argument for keeping trailing stops on individual stocks, just look back at this chart.

(USG is now so oversold it might be worth watching for a turnaround…)

Mon 10 Jul 2006

On the subject of hedge funds, I started reading Inside the House of Money a couple of weeks ago… it’s a series of interviews with some of the top Macro Strategy hedge fund managers out there today. It is sort of a modern day Market Wizards (Inside was published in April 2006), though the author only chose to interview Macro Strategy types of hedge funds. His definition of Macro Strategy is basically: discretionary, big picture investors.

The book focuses on strategies, personalities, and general economic outlook. The few chapters I have read are entertaining as well as informative…

Oh, and sorry, this one isn’t available to borrow yet… not while I’m still reading it. 😉

Sun 9 Jul 2006

My topic for today’s meeting will be a tactical one, and I hope to answer the question, “How can I limit the risk of the fundsI put into a given mutual fund?”

I use mutual funds for general asset allocation, usually for funds in taxable accounts to minimize taxable sales. (I use my retirement accounts for trading that typically creates holdings of less than 1 year.) At times, I might choose to invest large amounts in a single mutual fund to get to my asset allocation targets (e.g. 20% in international stocks).

If international stocks or gold stocks go down a helluva lot (which they have great tendency to do), do I just accept it as my fate? Not I… So, how do I limit my risk?

(more…)

Sat 8 Jul 2006

This will be the most juicy post thus far regarding PowerRatings. I signed up for the free trial (required a credit card, so I used one that’s set to expire on 7/31/2006–ha ha). I went straight to see the top 25 stocks with PowerRatings. They are posted below: (more…)

Sat 8 Jul 2006

In response to the comments from Data Set #1 post, I have created a second data set to lookup the PowerRating on each of the 500 stocks (large cap) in the S&P 500. I will bring a print-out of my findings to the upcoming Tasgall meeting and this will be the topic of my discussion. A summary of my findings are below: (more…)

Wed 5 Jul 2006

Well, I didn’t get much data that was worthwhile from Trading Market’s PowerRatings system. Since the free tool that they have available allows you to plug in one by one the stocks you’re interested in, I ran 3 separate screens from another site to create a bag of stocks to use. I just picked a random stock screening site and used their built-in screen to search for the best Value stocks, best Growth stocks, and stocks with Recent Brokerage Upgrades.