Tue 19 Sep 2006

Movin’ On UP: The Uberman’s Portfolio Update

Posted by Quicksilver under Uberman's Portfolio[2] Comments

By popular demand, I’d like to post an update of the real-money Uberman’s Portfolio to date.? As you may recall, armed with the?power of Grayskull?and some ring with crazy writing on it that I got from a giant eyeball on a mountaintop (something about “forged from the fires of Doom blah blah blah”), I took the plunge with my own cash at the start of August.? Since then, I’ve risen at 8am each Monday to perform my dark magic (hit F9 in Excel) and slay the dragons of the market (spend 5 minutes typing in some orders then crawl into the shower).? I spend the rest of the week slavishly watching my assets fluctuate wildly (watching girl’s assets fluctuate wildly), hoping against hope that I’ll come out ahead in the end (umm…).? Then, the ugly cycle repeats…

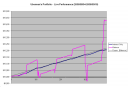

Ok, so it isn’t quite like that.? It’s pretty damn boring?but utterly satisfying as things really seem to be moving along as planned.? Here is a chart I made using the actual account statement, adjusted only to a base of $10,000 for easy reading.? Unfortunately, the account statement only lists balance and not NAV so you only see realized PL and not any open, unrealized PL.? That’s why you get that crazy back and forth look to the line.? If the portfolio tries to sell only the positions that are in the red, it brings that line down.? If it cashes out of positions that are in the black, it moves it up.? What’s important is to note the “interest only” line (the benchmark) and the exponential curve fit of the balance.? When these are close, you have a working model.? Championship!? It’s even more satisfying to know that this represents constant investment 24/7/365.? Now that’s what I call putting my money to work.

The annualized return so far is 18.024% on the interest only including reinvestment of profits.? What leverage does this represent? Well about 8:1 as of this week’s trading.? But over the life of the account, several, as I not only change it weekly based on a position sizing formula involving expected volatility and returns, but I’ve also slowly ramped up the risk tolerance over time.? About 4-5 different parameters go into deciding how much to leverage but I can say that I’m attempting to keep the return as high as possible while keeping the risk of ruin outside my confidence intervals.? My goal as always been around 20% return and so far the risk model and my goals have been in synch.? Playing with risk is always just a guessing game so I just try to do my best and ask, “Does this seem unreasonable?”.

September 20th, 2006 at 7:13 am

Were there any adverse impacts from the currency market movements, like say the Thai Baht yesterday (when the coup was announced)?

September 20th, 2006 at 9:42 am

No, no more than volatility would indicate is normal. Especially with the Thai Baht since I only deal with “major” currencies. As far as currency exposure, that’s what is behind the pink line’s movements. The only way there exists unrealized or realized PL is through market movement. But the goal is for the long-term net of market movement profits to be $0, meaning a return to the blue line. Interest is not counted in PL but does show up in the balance each day.