Wed 13 Jun 2007

The NY Times has a new Freakonomics article about cash-back financing from real estate transactions. The gist is that, even though illegal, real estate buyers have been frequently using cash-back financing to come up with the down payment for their new homes.

So, not only are the weak hands in the real estate market going with adjustable rate loans during a period of historically low interest rates, but they’re also levering up additionally just to get the down payment…

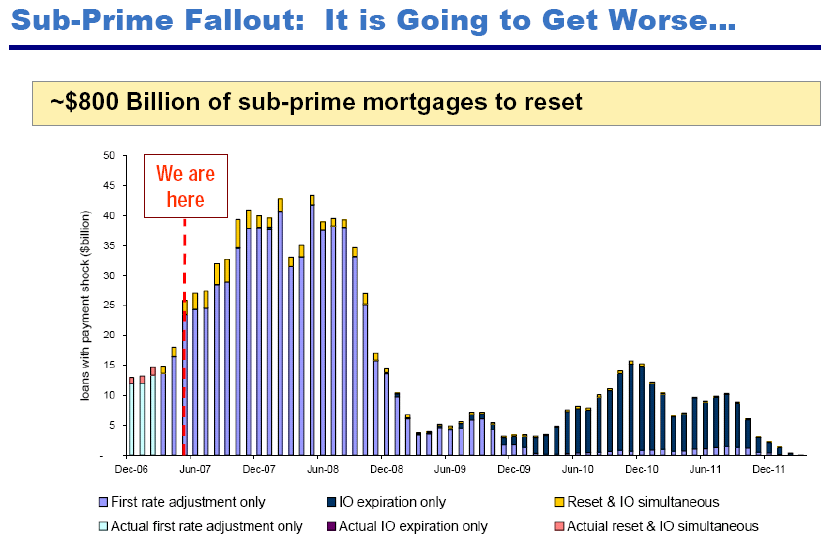

Here’s a good chart (from Mish) that shows how many of those adjustable rate loans are about to reset…

Even though some areas continue to be stable, I think we can expect continued weakness in those areas that used to be ultra-hot…

A quick check of the mortgage-lender implode-o-meter shows over 80 mortgage companies have run into trouble…

June 15th, 2007 at 8:19 am

I know I should be commenting on the content of this article, but I have to say, great graphic, and I love the way it launched. If you’re going to give me some bad news, at least you’re willing to do so in style.