Sun 1 Jul 2007

The Mercurial Quicksilver Returns

Posted by Quicksilver under Trading , Uberman's Portfolio[2] Comments

What the hell is my problem?

I can’t find time to write a simple entry in this blog for 8 months while taking on a new job, getting married, going on a honeymoon and moving from the East to West coast? Gosh!

Well, that’s about to change. [incredulous looks…] A new life on a new coast means new ways. I’m using the new change in my life the way an obese smoker uses New Year’s Day to get a gym membership. I will be a actively contributing member to this blog and the group I help to found. Ok, I said it. Now let’s put it behind us and go to the one topic that would be best to return to after so much time: the status of the Uberman’s Portfolio.

I have to admit that part of the reason I’ve been so out of touch is that I’ve stopped paying enough attention to the market as a whole since my money is tied up in the portfolio. It requires a very specific focus and not much outside of that. But my interest in all things markets keeps calling. I digress.

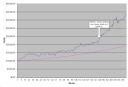

Let me just say, this is fun investing. Never underestimate the fun of making money. The blue line is equity and the pink line is the interest component of the equity. This represents reinvesting profits at 7.5:1 leverage. Any given investor in the portfolio might use leverage higher or lower but for the sake of illustration I had to pick a representative number.

That’s the good news. The bad news is that the blue line is diverging from the pink. It’s not supposed to. This can only mean one thing in my book: possible bubble in the carry. Of course, that’s not really news. Everyone knows there is a party going on in the carry trade (and we all should be skeptical when everyone knows something). So on that note, I’ll say that I’ll be following up with more analysis about the existence or nature of such a bubble and what it could mean.

Ah, it’s good to be back.

July 1st, 2007 at 9:22 pm

Very impressive equity curve… and yes, it is a little bit …unusual… to depart from your expected return by so much.

Would your portfolio shift to cash (USD?) if all the currencies started acting with volatility? Or do you just find the ones with carry that have the lowest relative volatility?

July 3rd, 2007 at 1:20 am

I think that question, whether is it unusual, is not necessarily clearcut. Should someone expect a slight lift from the expectation of future interest that itself gets compounded from reinvestment thus creating the exponential divergence? It’s a question I think about a great deal.

As for the shift to cash, yes if the combination of volatility, return and leverage given by my calculations led to a return that wasn’t attractive compared to a risk-free return, I would shift to cash.