Wed 11 Jul 2007

A few days ago I was asked how real estate was doing in Las Vegas…

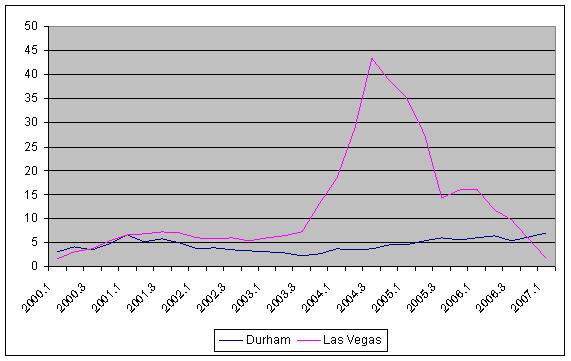

Here’s the a chart from the government’s official house price appreciation (compared to Durham for kicks and giggles):

Within the metropolitan area of Las Vegas, there are approximately:

- 7,132 pre-foreclosure properties

- 2,457 properties up for auction

- 5,365 bank owned properties (e.g., the foreclosure occurred and now the bank owns the house/property)

Here are the same numbers for Raleigh. For comparison, Raleigh is about half the size of Las Vegas:

- 557 pre-foreclosure (15% as much as Las Vegas, adjusted for population)

- 7 auction (0.5%, adjusted for population)

- 562 bank owned (20%, adjusted for population)

And to add insult to injury, the average price of pre-foreclosure houses listed on RealtyTrac (where I looked this up) was approximately 2x or more in Las Vegas, despite only have a 20% higher cost of living…

There’s also an interesting ecological / health issue with pools attached to abandoned or underfunded properties… the stagnant standing water (if not property treated with chemicals) are a hotbed for mosquitoes and mosquito related program activities.

The Southern Nevada Health District, which includes pool-packed Las Vegas, relies on neighbors’ complaints to identify pools green with algae. By June 25, the district’s “green pool” count outpaced last year’s numbers by more than a fourth. Many involved vacant homes in the process of foreclosure, environmental health supervisor Mark Bergtholdt says.

(The pool/mosquito problem is also present in Southern California and Arizona where pools are common and foreclosures are unfortunately increasing.)

July 11th, 2007 at 1:31 pm

Speaking of foreclosures and SoCal, I had an interesting thought on the bus this morning. Given my current salary at 41% above the area’s median income, I could, assuming a 20% downpayment, afford a house priced at around $350,000. This is based on the theory that about 50% of your after tax-income should go towards absolutely non-optional expenses and doing all the math related to what non-housing expenses take from that piece of the pie. With that said, the median house price here is $672,400 (8.6x the income)! The guy in the middle making $78,037 (median income here) is basically in trouble if they haven’t bought yet. Only in SoCal could I be making 41% above the median and only afford a house that is 48% less than the median. Just in case you were wondering, $350,000 houses don’t even exist here (at least ones you would want to live in) so renting is the only option if you are sane about how you spend your money. I don’t particularly mind to be honest. My happiness is not tied to home ownership. By the way, the median house was $330,100 in 2000 so I’m guessing it’s a case of people who got in on time got to ride the wave up. The rest of us rent from them. The median rent is only $1400, more in like with 2000 prices than with 2006 prices. Is it wrong to actually root for a housing slump around here? What’s a yuppie to do?

For Durham, the numbers are $42,421 and $157,100 (3.7x the income) respectively.

Data courtesy of City Data