Tue 31 Jul 2007

I wanted to highlight a specific trade that I’ve been in, as well as some commentary to go along with it.

There has been much hullabaloo in the market press lately about the subrpime fallout. We’ve seen credit markets contract, lending standards shoot up, mortgage rates climb, etc. One of the principle instruments of this trend are the CDSs (Credit Default Swaps) and similarly abbreviated CDOs, CDLs, etc.

A while ago, I found a mutual fund that invests in the opposite side of the CDS market, and benefits if defaults or perception of default start to rise.

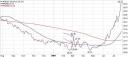

It trades under the symbol AFBIX with the long name, Access Flex Bear High Yield Fund. Here is a chart of the mutual fund’s price:

There are two important points to make.? One is that today, with a plethora of investment tools available, you can profit from just about anything — even if it’s profiting from credit contraction.

The second point is mutual fund entry isn’t as precise as normal stocks.? I highlighted on the chart two points… the red arrow was the price of the mutual fund when I put in my buy order, and the blue arrow was the price that I bought at. One of the nasty side-effects of end-of-day market pricing for mutual funds is that I paid an extra 1-2% for the privilege of buying this fund on that date.

I bought on March 5, only a week after the memorable 400 point single-day drop in the Dow on 2/27… when liquidity started to look like it was in danger of contracting.? The fund has really taken off in the last two months as the credit markets have undergone additional stresses.

Just like my other trades, I am keeping a trailing stop on this position.? I expect to overshoot my stop as I will probably lose another 1-2% due to end-of-day pricing, and have factored that in to my risk analysis and position sizing.