March 2008

Monthly Archive

Thu 27 Mar 2008

Posted by Jason G. under

Commentary1 Comment

A quote I came across today…

?”As of the end of the fourth quarter of 2007, 5.82% of all mortgages were delinquent, with fixed and adjustable subprime mortgages running at a 14% and 20% delinquency rate, respectively.”

On an unrelated topic, my previous question of whether or not you should consider credit a form of emergency savings…? you shouldn’t.? From Mish:

Nina writes…? “I?ve always believed that keeping a HELOC readily available is the best insurance policy and the back-up plan for if / when the emergency fund runs empty…”? and then “..we got the letter from Citibank about our $168,000 line of credit: “We have determined that home values in your area, including your home value, have significantly declined. As a result of this decline, your home?s value no longer supports the current credit limit for your home equity line of credit. Therefore, we are reducing the credit limit for your home equity line of credit, effective March 18, 2008, to $10,000.”

Credit can, and in extreme circumstances will be withdrawn.? There is no substitute for cash, and credit is not an emergency fund.

On another topic, BSC (as per the rumors in my last post) is bankrupt.? It has managed to be sold for $1 billion thanks to a NY Fed bailout and the desire to keep the counterparty system from collapsing on itself.

My perspective on the bailout is this…? if you see your neighbor playing with firecrackers in their living room, and you warn them of the dangers…? you feel like you’ve (maybe) done your ethical duty.? But when their house catches on fire, you can’t stand there saying “I told you so…”, you have to grab your garden hose and try to help put out the fire.

The Fed’s parade of obtuse acronyms and abbreviations is their own modern day version of the garden hose.? Will it work?? Time will tell…? but they have to at least try to put out the fire before the whole neighborhood goes up in flames.

Does Bear Stearns (and the rest of Wall Street) deserve to be bailed out?? No, absolutely not.? But their house is on fire, and it blatantly threatens our own houses (society at large), so emergency measures are required.? The time to avoid moral hazard was two or three years ago.

Now I’m pretty much as “free market” as they come…? but I have to say either we don’t have government bailouts, or we regulate those who would receive said bailouts.? If the Fed is going to back-stop Wall Street (which, for all intents and purposes, it has to), regulation is required. ?You can’t have your cake and eat it too — or rather, you shouldn’t have your cake and eat it too.

Wed 12 Mar 2008

Posted by Jason G. under

CommentaryNo Comments

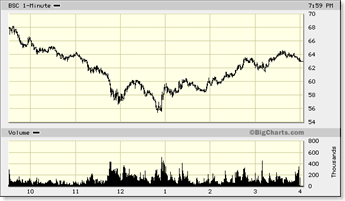

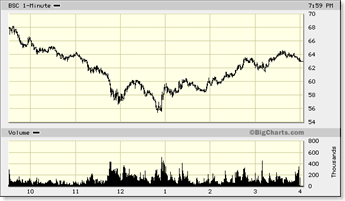

No, not da bear market… da Bear Stearns (BSC). Yesterday was one heckuva swing in the mid-tier broker. With a daily low of $55.42, and a daily high of $68.24, that is a whopping 23% move from peak to trough (and back, mostly) in one day. Here is a 1-day chart:

Even more amazing, rumors abound regarding the broker. Today there is a rumor going around that the Fed acted to keep Bear Stearns (BSC) from going under. Yesterday it was that Bear was at risk of bankruptcy, accompanied with a high volume of put action.

If the Fed did consider Bear’s position with yesterday’s TSLC announcement, I only have one thing to say… Counterparty risk is a bitch during a deleveraging cycle.

Wed 12 Mar 2008

Most of my thoughts about bottoms recently have focused more on the beach-bathing variety I’m starting to see as spring creeps back to the beach. But since everyone is wondering about the market bottom, I’ll bounce the proverbial quarter off of it and see how high it goes.

I’ve talked before about market “gravity” and price clusters that attract future bids. It’s based on basic auction theory: the price that attracts the most bidding represents the best guess at the value of an item even if people who really want the item badly (or are ill-informed or excited) will pay more (or in reverse auctions, less).

I’ve advanced my work on the idea by taking to the computer and working with the R statistical platform to analyze markets from an auction theory perspective.

So how does the?S&P look in this context? (more…)

Tue 11 Mar 2008

Posted by Jason G. under

CommentaryNo Comments

The Fed has proven yet again that they know how to time a market to either (a) make the most impact, or (b) improve their perception of market savior.

Allow me to explain… it should be obvious to anyone with a pulse that the S&P and the Dow Industrials broke down to new 52 week lows (on a closing basis) on Friday last week and Monday this week. If the market were to break down further, the Fed would potentially be allowing a systemic crisis to unfold… which is (as their logic continues) worse than a little inflation (which they “know” how to deal with). So, as the market is at risk, pull out all the stops and give the stock markets a little juice!

As to my cynical view (option “b” above), the stock markets were also very oversold, and basically at the bottom of their downtrending channels. As a matter of typical trading, the S&P and Dow were due for a bounce, or at least some sideways action for a few days. What did the Fed accomplish with this cynical view? As many people have recently questioned the impact of the Fed, they make themselves out to look like the savior of the markets, taking credit for the bounce that was high likely even without their action. At least, the mainstream media is quick to credit them… and the Fed knows that it is better to have the popular opinion on their side than blaming them for not acting.

Now the bad news… the one day zinger (up 3.7% on S&P, up 3.55% on Dow, and up 4.1% on the Nasdaq) has only reversed the losses from the last three trading days. While the equity markets may benefit from an additional bounce from here, it is worth noting that this is the 3rd or 4th time (I’ve lost count) that the Fed has resorted to “bailout” measures and used market timing to maximize their effect…? only to face panic again within a few months time.

What is the net effect?? An orderly decline, and giving banks time to earn revenue to dig themselves out of the holes in which they inconveniently find themselves.

Mon 10 Mar 2008

Posted by Quicksilver under

TradingNo Comments

I thought these suggestions for traders?from NakedShorts was too good to not repeat here:

It is far more important to look to simplicity (and common sense) than it is to look to increasing complexity as a means to better control investment outcome.

A model whose robustness is unknown or unknowable should never be employed.

Sophisticated tools should only be used if it is possible to verify that all required assumptions are satisfied (at least to a good approximation).? When this condition can be met, a simple application of a sophisticated technique is preferable to a complicated one.

Sat 8 Mar 2008

Posted by Quicksilver under

Commentary[2] Comments

Has anyone seen the TIP rates? TIPS are inflation protected Treasury bonds and arguably offer a view of the minimum amount of “risk-free” real?return people expect on their money. According to Accrued Interest, the 2-year TIP yield is now -0.72%. That’s negative zero point seven two percent. People are willing to give their money away for the next two years to avoid?risking more in risky assets. This fits in line with the poor rates Jason pointed out at his banks. Throw inflation into the picture and they lose money. It kind of reminds me of people being held up at gun point and sheepishly handing over their wallet to keep from getting shot. It’s criminal. But keep reading the article above for some interesting alternatives that take advantage of the situation we find ourselves in.

Sat 8 Mar 2008

Posted by Quicksilver under

CommentaryNo Comments

With the R-word everywhere these days, I thought I’d remind readers of this quote from Ahead of the Curve:

Perhaps the single most important insight in economically getting ?Ahead of the Curve? is that of recognizing the lagging characteristic, even deceptiveness, of ?recession? as a measure of economic downturn. Businesses suffer loss of sales, inventory buildup, and slowing-to-declining corporate profits when the rate of growth in economic activity (real GDP, measured here on a year-over-year percent change basis to provide clarity) begins to slow from its peak. (more…)

Thu 6 Mar 2008

Posted by Jason G. under

Commentary[2] Comments

Worth sharing from The BigPicture:

Moody’s Economy.com estimates that 8.8 million homeowners — about 10.3% percent of all U.S. homes — will have zero or negative equity by the end of this month. Another 10-15 million households are at risk of becoming "upside down" if prices continue falling.

Holy crap. The potential for 20 million homes, or close to 28% of homes could be under water… no wonder so many people are walking away, or considering it.

I also read somewhere (unfortunately, I couldn’t find the source) that 20% of subprime adjustable rate mortgages have delayed payments. And that number does not include the 12% of subprime ARMs that are currently in foreclosure.

Before the fit hit the shan, Nouriel Roubini was chided as being a perma-bear with the most pessimistic outlook imaginable… and he recently stated that in the context of everything that is going on today, he was truly guilty of being too optimistic.

Sun 2 Mar 2008

Posted by Jason G. under

Research[2] Comments

As a matter of course, in the past I’ve looked at quite a few municipal bond funds… including those that are closed-end funds trading at a discount. I even had large chunks of money in a municipal money market fund at one point… these might be things to avoid for the near term.

From Peter Sedacca on Minyanville:

As a follow up to the couple of pieces I wrote on munis, the Shoe has officially dropped… like an anvil.

Sources are telling me that the municipal bond market has all but seized up. Bid list after bid list surface, but nothing trades. The reality is that the bids are 10-15 points under statement values.

I have also heard of a few muni arb funds liquidating and shutting down (these funds mainly buy munis and short govies when the spread is wide). Well, it will get wider, and wider, and wider, until the margin clerk arrives.

If I owned a muni fund, I would not trust the nav, particularly in closed end levered funds. Be careful, folks. And don’t panic…

Sounds scary. Rather than "don’t panic", I would offer different advice — panic early, beat the rush.

Mish has more on his blog, a "forced unwind in leverage is now underway… Anyone over-leveraged in anything right now should be scared half to death."

Sat 1 Mar 2008

Posted by Jason G. under

TradingNo Comments

Now that Fidel Castro is stepping aside, it might be worth taking a look at the closed-end fund CUBA again. As we might expect, there was quite a pop on 2/19 when the news was announced — going from $7.50 to $9… about 20%.

As a closed-end fund, it is worth taking a look at the discount/premium to NAV:

While the chart doesn’t show it (the last data point is Jan 08), the fund is currently trading at a 9.9% premium to NAV. The impressive thing is that the fund is back down off it’s 70%+ premium at it’s highest.

Even more telling is this 3 year chart…

As you can tell, when Fidel went into the hospital in August 06, it preceded a rather large spike in the share price of the ETF. Yes, the share price traded well over 70% above the NAV, but as a trader of the security, you have the advantage to sell at the market price regardless of the NAV. Also important, the volume spike this month was much higher than anything we saw back in 2006 or 2007.

Would I put money on the line with CUBA right now? If I could manage the risk to my satisfaction, I would certainly consider it. There is one significant difference between the end of 2006 and today… the overall market has gone from a bullish/happy/speculative mood into a more somber/worried/panicky mood. That alone warrants caution when considering going long on pure speculations like this.

Will Cuba (the country) benefit from Raul Castro being in control instead of Fidel? Probably not in the short term, but as we have all witnessed from time to time, markets have the ability to trade independently from the reality on the ground.