October 2008

Monthly Archive

Sun 5 Oct 2008

Posted by Jason G. under

Macro1 Comment

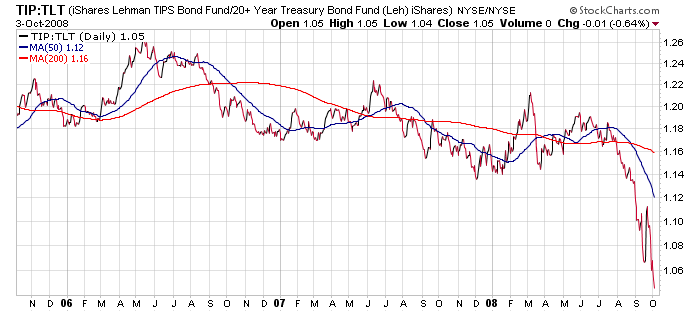

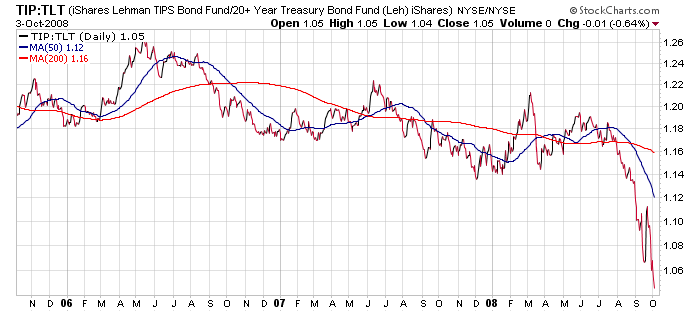

Just a quick comment on something I’m observing… the TIP/TLT ratio is falling rather quickly, which implies that market expectations of inflation are dropping. In fact, this indicator argues for a big deflation scare that is coming down the pipeline.

Yes, the bailout, Fed actions, and Treasury spending all are hugely inflationary, but I am pretty sure you’ll be hearing more about deflation soon.

Wed 1 Oct 2008

Ok, people, if this?thing is going to happen, that obviously sets us up for a certain future, depending on your views. So, if you had $100,000 to invest in the aftermath of a bill passing and you had total flexibility (within reason, e.g. stocks, options, futures, metals, Treasuries, FX), do you have a bead on an optimal “Living-with-the-Bailout” portfolio/asset allocation plan? I’m stumped right now (or rather more concerned with stopping the bill that dealing with the aftereffects) but wondered if any of you smart dudes had one in the works. And I obviously know that you all will be concentrating on things like debt reduction etc. but I’m interested more in your ideas for profiting from this even if you don’t plan to actually pursue that route. I’d also like to see how the plan ties into your outlook for various markets.

Wed 1 Oct 2008

Posted by Jason G. under

Macro1 Comment

Wonder why the US Dollar is so strong against the Euro lately? The European banks were apparently using AIG to get past capital reserve requirements… and with AIG being knocked out of the game, a lot of problems start piling up quickly…

The K-10 annex of AIG?s last annual report reveals that AIG had written coverage for over US$ 300 billion of credit insurance for European banks. The comment by AIG itself on these positions is: ??. for the purpose of providing them with regulatory capital relief rather than risk mitigation in exchange for a minimum guaranteed fee?. AIG thus helped to organise regulatory arbitrage on a gigantic scale. A formal default of AIG would have had a devastating impact on banks in Europe. This explains why AIG?s problems had sent shock waves through the share prices of European banks. For the time being the US Treasury has saved, inter alia, the European banking system, but given that AIG is to be liquidated European banks now have to scramble to find other ways of obtaining the ?regulatory capital relief? they appear to need urgently.

Get all that? It’s less well known than it should be, but Europeans banks have long been gaming their regulators, having far less than the actual capital reserves that they needed given their balance sheets. AIG filled the hole, selling credit defaults swaps to European banks via which they could tell regulators that they were adequately covered — at triple-A, no less — while carrying less cash than required.

From Kedrosky.

Wed 1 Oct 2008

Posted by Jason G. under

Macro1 Comment

As a note about how quickly things change… the BDI (Baltic Dry Index) has gone from a little over $11,000 in May 2008 to right around $3,200 today. I’m not sure what units that is measured in (dollars per ton per 1000 miles?), but if you’re shipping tons of raw materials by ship, you just saw your shipping costs get cut by over 2/3 in about 5 months.

This isn’t some stock market where we have “evil short sellers” or forced selling through margin calls… and it’s not a bond market where people are refusing to lend each other money… this is the material cost to ship something around the world, and it’s crashing hard.

« Previous Page