Wed 22 Apr 2009

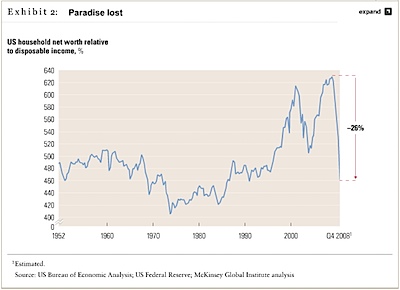

From McKensey, and interesting look at household net worth relative to disposable income.

So far the net worth has fallen a good deal more than in the 2001 bear market… the result being a decrease in consumption and an increased savings rate to make up for the losses.

Implicit in the chart is the fact that household net worths, in aggregate, fell about 160% of annualized disposable income. That means consumers would need to save every possible (discretionary) penny for the next year and a half to get back to the recent high.