If you got a K-1 from a LP or Publicly Traded Partnership (PTP) that you owned, the Tax Package Support website will help you account for things properly…

March 2010

Sat 27 Mar 2010

Wed 24 Mar 2010

I found the following from Zero Hedge to be very insightful and wanted to share…

After Paul rips Bernanke’s face off with the Chairman’s constant excuse that regulation is the answer to everything, arguing instead that artificially low rates merely send constantly flawed price signals, Bernanke retorts “Well you need some system to set the money supply. I guess you are a gold standard supporter.” At this point Paul gives the most priceless response ever: “I am for the constitution.“

…

[Brad Sherman asks] “Bureaucracies hate bad headlines, they’ll often do desperate things behind the scenes to avoid that big headline from breaking. Prudential regulators are going to get bad headlines if a big institution fails, particularly under some circumstances, and if they can prevent that failure, if they can just put it off for six months, their reputations and careers can be saved. Monetary policy, just cutting the interest rate by quarter point can save a troubled institution. So how can we be sure that monetary policy is not influenced by the natural human desire of bank supervisors, to save one or two institutions, for at least long enough for them to move over to another department. How do we make sure that monetary policy does not meet the career needs of bank supervisors?“

…

And why does the Fed believe it has any credibility as an uber-regulator when it constantly fails a less than uber-one?

Read the whole piece for more, and they also have embedded YouTube videos of the exchanges.

Tue 16 Mar 2010

Yay, the stock market is up, the economy is getting better, and we solved the mortgage problem — all it cost us was a few trillion dollars (ok, more than a few). We’re out of the woods, right?

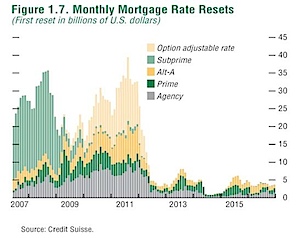

Here is the chart we looked at a while ago with when mortgages with variable rates reset those rates… notice the big wave of green-ish stuff in 2007 and 2008? That’s what we just finished dealing with.

You might also notice that in front of us there is a big wave of yellow-ish stuff in 2010 and 2011. Interesting, no?

John Hussman wrote about this in his weekly review:

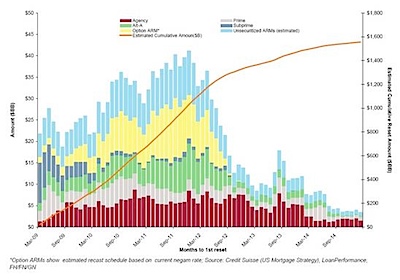

Below is a slightly different schedule we’ve seen. It doesn’t show the first round of sub-prime resets that ended in early 2009, and is based on different classifications, but is largely consistent with the overall profile we can anticipate.

…To reiterate what the reset curve looks like here, the 2010 peak doesn’t really get going until July-Sep (with delinquencies likely to peak about 3 months later, and foreclosures about 3 months after that). A larger peak will occur the second half of 2011. I remain concerned that we could quickly accumulate hundreds of billions of dollars of loan resets in the coming months, and in that case, would expect to see about 40% of those go delinquent based on the sub-prime curve and the delinquency rate on earlier Alt-A loans.

If it cost us several trillion dollars, including nationalizing Fannie and Freddie to deal with the subprime wave of resets, what might happen with the second wave?