Sat 12 Apr 2008

From Bloomberg:

On a conference call today, analysts demanded that Immelt explain why he told retail investors on a March 13 Webcast that Fairfield, Connecticut-based GE would likely meet its annual forecast of at least $2.42 a share.

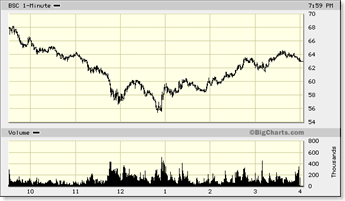

“Two days after the Webcast, the Bear Stearns situation took place,” Immelt said. “The last two weeks in March were a different world in financial services.”

There is plenty of criticism going around, and rightfully so.? But unless GE was directly invested in Bear Stearns shares, this shouldn’t have had such a big impact on it’s quarterly earnings.? But if we look past the headlines, we might be able to see why this really happened.

For several years now, GE has always met or beat earnings estimates by a penny every quarter.? This is basically impossible to do for a company that size without doing some fancy footwork.? That footwork usually involved GE Financial, and specifically buying or selling large assets in order to smooth their earnings in any given quarter.

From the article, “GE put its U.S. credit card business and Japanese consumer finance units up for sale last year.”? These are two of the assets that they were planning on selling to help them smooth out this quarter’s earnings and meet the earnings that they had originally stated.

So, while many people are pointing to GE and saying they’re a financial company disguised as a manufacturing company.? While that is partially true, it is not surprising to me that when the Bear Stearns collapse rattled wall street, no one wanted to buy GE’s assets to help them out — everyone who was able to buy assets of this size was busy covering their own balance sheets…

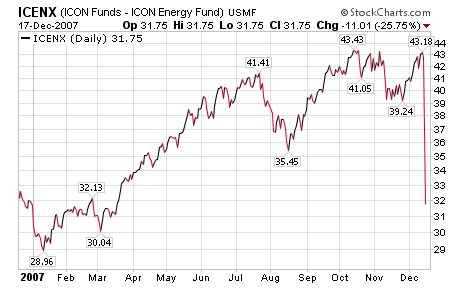

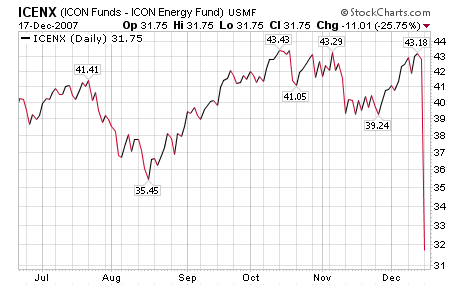

So, did GE deserve the brutal reaction on Friday?? (The stock closed down 12% for the day.)? Yes, but I think it also opened up an opportunity.

I don’t know whether GE will fall out of good graces with institutional investors because of this, but I believe their business is strong and their strategy (outside of the financial footwork) will be successful in the long run.? This might be a good opportunity to buy shares of GE at the bottom of a 3 year long price channel.