I ran across some interesting points in a post titled Buyout Bingo Reversal Continues at Mish’s blog… the big private equity buyouts that were so prevalent only a few months ago include “breakup fees”, meaning fees that need to be paid if the buyout doesn’t go through.

In the case of Harmon International, the fees were $225 million. That means that KKR and Goldman Sachs (the buyers) would owe Harmon a rather large amount of money if the contract is honored. They do claim that their (KKR and GS) businesses have undergone “a material adverse change” and thus they shouldn’t be bound to the contract any more.

The Sallie Mae buyout apparently includes a whopping $900 million breakup fee.

Mish sums the case up pretty well:

None of these deals made any real economic sense but the deals did pad the pockets of the underwriters like Citigroup (C), Merrill Lynch (MER), Goldman Sachs (GS), Lehman (LEH), etc, with lucrative fees at least up until now.

With buyout bingo in reverse, underwriters are paying breakup fees to keep the large loans off their books. As long as investors were willing to take on risk (buy junk at insane prices), the underwriters danced the tune.

It’s telling that Citigroup, Goldman, etc, do not want the deals if they have to provide the funding themselves. Not only do they not want them, they are willing to pay breakup fees to get out of them. That should be enough to tell you who has been and remains the sucker in the deals that do go through: hedge funds and individual investors that buy into them. After all, if Goldman and Citigroup don’t want the deals or the debt, why should you?

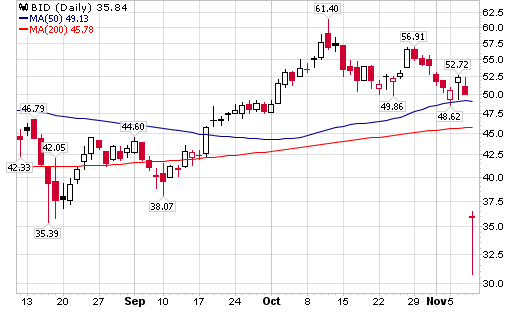

After two up days, and plenty of celebration over Apple and similar tech profits it’s easy to think that Friday’s drop was just a single bad day, overdone because of option expiration and what not… But one thing to keep an eye on over the next few days is the volume on up or down days…

After two up days, and plenty of celebration over Apple and similar tech profits it’s easy to think that Friday’s drop was just a single bad day, overdone because of option expiration and what not… But one thing to keep an eye on over the next few days is the volume on up or down days…