Sat 16 Sep 2006

Contraneoantidisinflationmentarianistically speaking…

Posted by Quicksilver under Commentary1 Comment

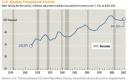

It was the best of times and the worst of times as commodities fell of the charts (almost literally).? Why is this troubling because I certainly don’t dread filling my tank us nearly as much lately?? Because such a rapid decrease in commodities prices could spell rapid deflation.? I know that is hard to swallow with so much concern recently on the inflation front.? But when assets decrease in value, the money supply shrinks, which is deflationary. (more…)