Here’s an interesting excerpt that I saw over at the blog Infectious Greed…

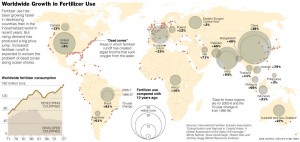

The remedy to high food prices is to increase food supply, something that is entirely feasible. The most realistic way to raise global supply is to replicate the Brazilian model of large, technologically sophisticated agro-companies supplying for the world market. To give one remarkable example, the time between harvesting one crop and planting the next, in effect the downtime for land, has been reduced an astounding thirty minutes. There are still many areas of the world that have good land which could be used far more productively if it was properly managed by large companies. For example, almost 90% of Mozambique?s land, an enormous area, is idle.

Unfortunately, large-scale commercial agriculture is unromantic. We laud the production style of the peasant: environmentally sustainable and human in scale. In respect of manufacturing and services we grew out of this fantasy years ago, but in agriculture it continues to contaminate our policies. In Europe and Japan huge public resources have been devoted to propping up small farms. The best that can be said for these policies is that we can afford them. In Africa, which cannot afford them, development agencies have oriented their entire efforts on agricultural development to peasant style production. As a result, Africa has less large-scale commercial agriculture than it had fifty years ago. Unfortunately, peasant farming is generally not well-suited to innovation and investment: the result has been that African agriculture has fallen further and further behind the advancing productivity frontier of the globalized commercial model.

As I read about this and annecdotes about ranchers reducing their cattle herds and chicken producers cutting back (due to the high cost of feed), I believe we’re going to have a food crisis sooner or later.

Here in the US, we will probably still be fed (if not over-fed), but it will cost more as a percentage of our total spending…? if some Americans are having trouble paying for gas to get back and forth to work (see Mish’s Pawnshow Society for more shocking annecdotes), what happens if your food costs shoot up alongside?? Maybe people will shift to simpler (vegetarian) diets, or be forced to cook at home more.

Regardless, with every danger is opportunity.? If beef becomes scarce, we can consider investing in Cattle Futures, or the relatively new ETN COW that tracks cattle futures (oh the ticker symbols!).? Likewise, DBA (agriculture ETF) has been good for trades in the past (DBA is only corn, wheat, sugar, and soybean, so it did not participate in the recent price run-up in rice).? General commodities funds/ETFs are normally overweight oil and energy, so it’s nice to have these focused funds/notes available if you’re interested in trading these trends.

A word on risk — the ETNs (exchange traded notes) have counter-party risk, which is something that doesn’t apply to ETFs or stocks…? if a major brokerage house or hedge fund is on the other end of those notes when it blows up, your holdings of an ETN like COW might be adversely affected.? It’s low probability, but a real one that you should be aware of.