Oops, the game isn’t “where’s waldo”, but rather “where’s volume?”

While commentators are clamoring that either the green shoots are taking root, or the world is about to end again… based on the relatively low trading volumes, nothing in the current market should be trusted as a means of price discovery or a measure of long-term trend.

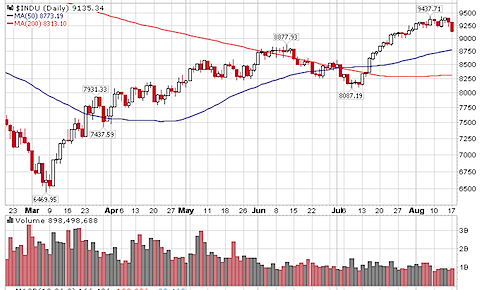

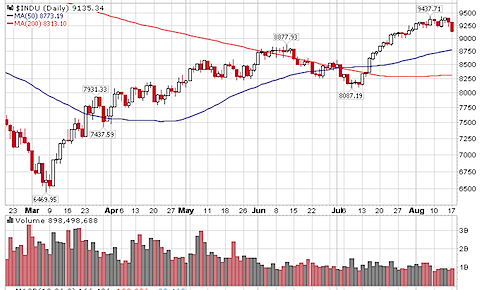

Take the Dow 30 as an example… the last 6 trading days have had less than 1 billion shares trade. Back in March and April, it was typically between 2b and 3b shares trading.

Of course, you do get some funny behavior when some of the index’s components were trading under $10, so number of shares necessarily increases to trade the same monetary value… and you can see most of 2007 was trading under 1b shares daily… but times are different, and it is that part of the year where the markets can be batted around with lower than typical volume.

We should see volume return in September or October… but only time will tell when the markets will see price movements on big volume that will give us the higher level of confidence that the market is actually acting like a market — seeking out the correct price level. When that time comes, remember that efficiency is a process, not a constant state of the markets.