Wed 21 Jan 2009

Mon 12 Jan 2009

Check out this nice MSNBC feature for jobs by sector and unemployment rates by state. On the state unemployment, be sure to note the slider at the top that allows you to shift it by each month of 2008.

What is fascinating to me is the number of sectors that are not in a downtrend for the second half of 2008… Local, State, and Federal Governments, as well as Education and Health Services (Quasi-Government), and “Other” Services. I’m not impressed by the uptrend in “Natural Resources and mining” due to its very small size by comparison to the other sectors.

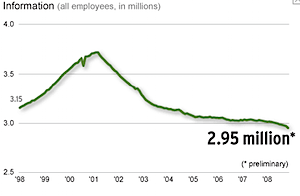

Also interesting, the “Information” sector, in which I believe we would fall, has been in a decline since 2001.

Sun 11 Jan 2009

Let me get out my crystal ball and make some commodity price predictions about the next two or three weeks…

- Oil and Copper prices will rise

- Gold and Cattle Futures will fall

What makes me think that I can predict something like this?

FT Alphaville: Beware, commodity index rebalancing ahead

?The major commodity indices rebalance their respective asset weightings once a year (or occasionally more) – and with that comes a mass dose of buying and selling. The 2009 rebalancing is expected to start sometime this week.

Luckily, JP Morgan has produced its best guess of how the 2009 reweightings of the DJ AIGCI and the S&P GSCI indices will impact the market.

The weightings for both indices are released ahead of time, but begin to kick in the first few working days of the new year. In the case of the DJ-AIGCI – which JP Morgan estimates has $25 billion in funds tracking it – the new weightings come into force during the roll period that begins January 9. The S&P GSCI index weightings kick-in after its January roll which commences January 8. JP Morgan estimates about $50 billion of investment into that index.

JP Morgan see the most significant change coming in the DJ-AIGCI rebalance. Here the market weight of crude oil is expected to increase from 9.6% to 13.8%, gold from 10.8% to 7.9%, copper (COMEX) from 4.5% to 7.3%, live cattle from 6.4% to 4.3% and sugar from 4.7% to 3.0%. Meanwhile, S&P GSCI crude oil weight will go from 32% to 33.8%?.

Don’t be surprised if we see volatility kick up a notch from here…

Sun 11 Jan 2009

There is a persistent headline out there about “cash on the sidelines”. For a quick explanation of the argument, here is a quote from perma-bull Louis Navellier:

There’s more cash available to buy shares than at any time in almost two decades, a sign to some of the most successful investors that equities will rebound after the worst year for U.S. stocks since the Great Depression.

The $8.85 trillion held in cash, bank deposits and money- market funds is equal to 74 percent of the market value of U.S. companies, the highest ratio since 1990, according to Federal Reserve data compiled by Leuthold Group and Bloomberg.

…Still, the fact remains that stock prices are low and once a rally starts, there’s plenty of fuel to carry it for a long time.

The argument goes, as long as there is cash on the sidelines, that cash will be used to rush into the stock market propelling prices higher.

Let’s do a little thought experiment… Suppose I am one of those people with cash on the sidelines with $1000 in cash in my brokerage account. I decide to buy $1000 of INTC with my cash, giving someone $1000 for about 67 shares of INTC. The counter-party on the trade now has 67 fewer shares of stock, but also has a new $1000 in cash in his brokerage account.

The same thing happens in the other direction… When I sell the 67 shares of INTC, I get more cash in my brokerage account, but the person who bought the shares from me previously had the same amount of cash “on the sidelines” in his account.

Wait a minute, there’s still $1000 in “cash on the sidelines” just like before the stock got bought… but instead of being in my brokerage account, it’s now in that other guys… What gives?

The deal is that the amount of cash on the sidelines will always remain the same. The higher amount of cash on the sidelines right now is a byproduct of Fed easing and attempts to increase the money supply more than any money “leaving the market”.

The lesson here is obvious… the next time you hear someone arguing that the market has to go up because of the amount of cash on the sidelines one of two conclusions is possible: the person is uninformed, or they’re selling something. In the case of Mr. Navellier, I believe he’s guilty of both faults — he’s ignorant of the dynamics at work as well as trying to sell his long-only investment newsletter.

Sun 11 Jan 2009

Tue 6 Jan 2009

There’s an interesting op-ed piece from Bloomberg columnest Matthew Lynn where he makes a few predictions for 2009… one of the ones I enjoyed was this section:

Bust Culture

Five, the rise of frugality gurus: After the bling culture, we will need to get used to the bust culture. Television channels will clear all the real-estate shows from their schedules, replacing them with guides to growing your own vegetables. We will take pride in making our cars cover that second 100,000 miles. A new breed of frugality gurus will emerge out of the recession, dispensing tips on how to make the pennies go further. The best ones will make a fortune.

Anyone want to become a Frugality Guru?

Mon 5 Jan 2009

This is a good article by John Hussman about portfolio rebalancing and matching your timeframe to your portfolio’s duration. If your primary tool for investment tweaking is asset allocation, it is very good to give you an extra dimension from what you probably already know well.

With the recent surge in Treasury bond prices, the effective duration of a 30-year Treasury bond has climbed from just over 16 years to nearly 20 years. Meanwhile, the plunge in the stock market has collapsed the duration of the S&P 500 from nearly 60 years to just about 30 today.

For investors who rebalance their portfolios annually, this is essential information. Given the probable long-term returns that stocks and Treasury bonds are priced to deliver, an investor seeking a 7% long-term total return would currently require an allocation of about 60% in stocks and 17% in bonds, for an overall portfolio duration of about 21 years ? only a third of the duration that an investor seeking that same long-term return would have had to accept just 15 months ago! Given the poor long-term returns that Treasury bonds are priced to deliver, an investor with any view at all about market direction would likely forego the 17% allocation to long-term bonds, opting for shorter-duration (and only slightly lower yielding) securities until the Treasury market normalizes.

Sat 3 Jan 2009

The tired old measure of bull and bear markets are a 20% move in one direction… a purely arbitrary measure of bull/bearishness, but something that a lot of people tend to latch on to.

With that definition, we are currently in a bull market. Even before Friday’s surge, the S&P 500 has gone from a low of 741 at the end of November to a high of 918 around mid-December. That’s a 24% gain in a month, making it a bull market by the “20%” definition.

Does it feel like a bull market to you?

Fri 2 Jan 2009

With everyone a-buzz over lower mortgage rates and the large number of people applying for refinancing their mortgages, it might be time to check in on the unintended consequences.

Mr. Mortgage has a good piece titled Low Mortgage Rates to Spur New Wave of Defaults. His argument is that many of those looking to refinance will be rejected, bringing the housing crisis to full front-row impact to all the prime borrowers out there. Here’s a quote:

[Today] the first thing done after the loan application is taken is to call the appraiser for a comparable sale check to see if the value at which the home owner states the house is worth is on target.

Therein lays the rub.

From early reports since rates fell sharply in early December, 80% of the loan applications are not getting out of the starting gate easily. Loan officers are all saying the same thing ? that appraisals are not coming at value due because ?all of the foreclosures and REO sales have taken the value down?. In the majority of these cases, this kills the loan.

The loan officer then notifies the borrower of the news and they are in disbelief. All home owners think that their home is worth the most on the block and I have been told that this is a tough pill to swallow. This brings the crisis home instantly.

Everyone trying to refinance into lower rates at once should hasten the national reality that the largest portion of the home owner?s net worth has evaporated in the past year. One loan officer I spoke with equated this call to a Doctor notifying a patient that they had a terminal illness.

The other three top reasons that loans are not making it out of the application phaseare because of credit scores coming in too low, interest rates not really being what the borrowers are hearing hyped and Jumbo money is near all-time highs.

It may or may not cause the defaults Mr. Mortgage predicts, but there are usually some unintended consequences that wreak more havoc than anticipated… and this would fit the bill for an unanticipated result of lower mortgage rates.

Thu 1 Jan 2009

Paul Wilmott is a pretty big name amongst Quants, and it is amusing to read his blog. He recently wrote a little blurb on economic models, and the economists who should give back their Nobel Prizes… The problem is economists who trick themselves into the mistake of adding complexity to a model in the theory that it improves accuracy…

We don?t need more complex economics models. Nor do we need that fourteenth stochastic variable in finance. We need simplicity and robustness. We need to accept that the models of human behaviour will never be perfect. We need to accept all that, and then build in a nice safety margin in our forecasts, prices and measures of risk.