Fri 25 Jul 2008

Wed 23 Jul 2008

Making the rounds…? Still President Bush says Wall Street “got drunk” and “has a hangover”.

Tue 22 Jul 2008

Sat 19 Jul 2008

On the lighter side… Just found, and thought it was interesting enough to share…? Stock Twits.? Just in case you want an even more spastic view of the markets…? but it might be useful to watch the rumor flow or day-trading junkies.

Also useful is BreakingNewsOn which attempts to identify breaking news.? There are a few news stories, including the passing of Tim Russert, that have supposedly popped up on Twitter well before any mainstream media.

Fri 18 Jul 2008

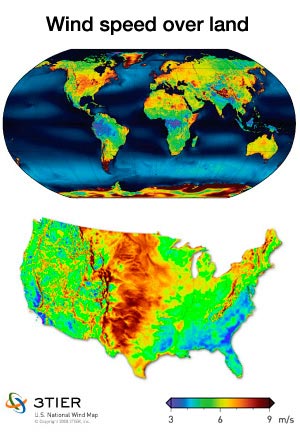

Apparently T. Boone Pickens wants to solve our energy dependence issues…? and he thinks Wind is a good way to do it.? At right is an image of the wind potential of the world, including the “wind corridor” of the midwest.

Apparently T. Boone Pickens wants to solve our energy dependence issues…? and he thinks Wind is a good way to do it.? At right is an image of the wind potential of the world, including the “wind corridor” of the midwest.

Go to PickensPlan.org for more details of his plan.? Of course Pickens is a private investor and has put his own money into building wind farms, but the whole effort seems remniscient of Al Gore’s global warming campaign…? perhaps Pickens is thinking about his legacy as well as profits?

If you believe wind is a growth industry (which it will be if Pickens is right), you should know about a new ETF with the ticker FAN.? It’s only been trading for two weeks, but plans to track the growth in wind power by investing in ~50 companies active in wind.

Thu 17 Jul 2008

It’s worth doing a quick review of personal finance tools…? while it’s fun to talk about the macro-economy, sometimes we just need to make sure our own little micro-corner of our personal finances are under control too.? The established players in the space are our old Quicken and MS Money:

I personally have a love/hate relationship with Quicken.? It is some of the worst software I’ve used, especially with the 2008 version.? It’s so bad that I would have stopped using it if it weren’t so darn useful.? A while back, I went looking for alternatives to Quicken or Money…

- Mint

- Wesabe

- Quicken Online – would it be less annoying than the desktop software?

- You Need a Budget

- Geezeo

- Yodlee’s MoneyCenter

- Rudder

The main drawback to almost all of these is that they are online/website solutions.? Can I trust my personal finances to some company’s website?? Beyond the usual paranoia of trusting other people, some of the marketing material leaves me a little curious how serious their security really is.

Anyone tried these out and have some feedback or suggestions?

Wed 16 Jul 2008

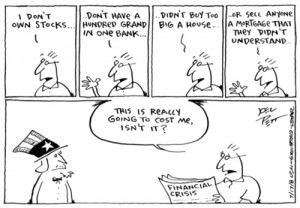

Sorry to keep bringing pessimism to the forum, but that’s just what stands out for me as I absorb news and such.? There’s a future post in what I perceive to be a large asymmetry in naive perspectives amongst the bullish lot.? Anyway, on to a quote from Paul Volker via Marc Fleury‘s blog:

Simply stated, the bright new financial system ? for all its talented participants, for all its rich rewards ? has failed the test of the market place.? Paul Volcker, April 8 2008

What’s the fallout?? Why is it not just about write downs and losses?? The current financial situation have not only caused losses, but they’ve also taken away the most profitable business for most banks and brokers.? From Nouriel Roubini (emphasis mine):

So how will mortgage brokers, banks, broker dealers, monoline insurers, rating agencies generate revenues and profits now that this slice & dice scheme has unraveled? The current market delusion that the worst is behind us for financial institutions is based on the view that most of the writedowns of the toxic assets have already been done. But this is not just a balance sheet problem. Now financial institutions have a more severe P&L problem, i.e. how to generate income and earnings from now on when they cannot originate junk any more. The entire income generating model of financial institutions ? make income out of securitization fees rather than by holding the credit risk – is broken now that the generalized credit bubble (not just subprime mortgages) has burst; thus, how will these financial institutions generate earnings over time? Capital losses are one-time problems; but destruction of the income generation process is a more severe and persistent problem that will require banks and other financial institutions to rethink their overall business model of credit risk transfer.

I know Quicksilver will respond with some comment about how Roubini is always bearish, but Nouriel also happens to have hit on an important point here.? Where will the income generation come from for banks?? If the Fed and Treasury really are trying to give the banks time to grow their way out of the current mess, where will that growth come from?

Tue 15 Jul 2008

This is a little old (June 2, 2008), but worth sharing…? John Hussman reviewed the FDIC Quarterly Banking profile…? here’s what he found.

?Industry earnings for the fourth quarter of 2007 were previously reported as $5.8 billion, but sizable restatements by a few institutions caused fourth quarter net income to decline to $646 million.?

Note what the FDIC is saying here. The banking industry reported $5.8 billion in earnings to its investors, but restatements took that total down by 89%. Stop and think about that – only 11% of the earnings that were reported to investors survived after the restatements. And yet, investors seem naively willing to take recent earnings reports, guidance and charge-off levels at face value, as if these reports can be trusted. Unfortunately, all that seems to matter to investors over the short-run is whether earnings-per-share can beat estimates by a penny, regardless of whether they are massively restated later.

Quite an indictment…? and the whole article is worth reading if you want to understand the state of banks today, and why they’re still not as cheap as one might think.

Mon 14 Jul 2008

The FDIC shut down IndyMac over the weekend, and I read the following quote in the International Herald Tribune:

The bank is scheduled to reopen Monday as IndyMac Federal Bank, FSB, under the oversight of the?FDIC.

The FDIC estimates its takeover of IndyMac will cost between $4 billion and $8?billion.

I was wondering, where does that $4 to $8 billion come from?? Here’s an explanation from the internets:

Where does the FDIC get its money?

From assessments on insured banks, and interest on U.S. Government securities it holds.How much do the insured banks pay the FDIC?

Insured banks pay annually a gross assessment of one-twelfth of 1 percent of their total deposits.What direct commitment does the Treasury have to the FDIC?

The 1947 amendments to the Federal Deposit Insurance Corporation Act provide that the FDIC can borrow up to $3 billion from the U.S. Treasury at its discretion. The law directs the Secretary of the Treasury to put up this $3 billion any time the FDIC wants it.

NOTE: The website/book is from 1962, so the details may have changed since then (it references a $10,000 insured amount, which has obviously changed).

IndyMac had about $20 billion in deposits earlier in the year…? which means their annual assessment would have been around $17 million dollars…

Just like the PBGC, it may be self funded, but as soon as demand for coverage overwhelms that self-funding, it is ultimately the tax payers that are on the hook.

Mon 14 Jul 2008

Marketwatch is leading with a headline this eveing saying “WaMu bucks bank trend“.? And indeed, the stock is up over 8% in after-hours trading…? but that’s hardly the whole story, despite a sensational headline…? Which one of the following details do you think is the most important for WaMu today?? The one where it “leaped” by 9% after hours, or the one where it went down over 34% earlier in the day?