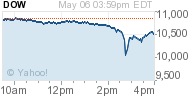

So, it started out as a bit of a down day, nothing crazy. And then around 2:40pm the bottom apparently fell out of the market. Dow down 998 points (give or take) before a V-shaped bounce back out of the crash to close down 348 points.

Apparently, the rumor at the time was that a trader at Citi fat-fingered a trade, putting a B in his sell order instead of an M, turning a million dollar trade into a billion dollar one. The interesting thing about that? Citi denies that anything like that happened. Third parties looked at the amount of volume Citi’s trading desk did, and said there was nothing unusual that could cause this kind of move.

Regardless of cause, aren’t there some sort of circuit breakers for when the market drops too quickly? Well, the curbs start at 10%, and the 10% curb is not in effect after 2:30pm. Very interesting that the whole thing went down at 2:40pm.

(From NYSE).

Had the market free-falled to be down 20%, the NYSE would have closed trading, ideally so everyone can catch their breath and cooler heads prevail.

Zero Hedge intelligently thinks it was caused by High Frequency Traders (HFT) all acting in a negative feedback system:

…absent the last minute intervention of still unknown powers, the market, for all intents and purposes, broke. Liquidity disappeared. What happened today was no fat finger, it was no panic selling by one major account: it was simply the impact of everyone in the HFT community going from port to starboard on the boat, at precisely the same time. And in doing so, these very actors, who in over a year have been complaining they are unfairly targeted because all they do is “provide liquidity”, did anything but what they claim is their sworn duty.

In 20 minutes the market showed that it is as broken as it was at the nadir of the market crash. Through its inactivity to investigate the market structure, the SEC has made things a million times worse…

After today investors will have little if any faith left in the US capital markets, assuming they had any to begin with.

That last point is an important one. How many people will see today’s market behavior and decide to sell in their 401k? If we go down big into the weekend, are we setting ourselves up for another 1987 Black Monday Crash type event? (In case you didn’t know, the Thursday and Friday leading into the weekend were big down days, -2.4% and -4.6% respectively.)

On the flip side, those folks over at StockTwits have created a t-shirt to commemorate the brief crash…

My opinion? This market is basically fake… the melt-up that has been happening is a by-product of zero rates at the Fed and HFT trading… once some actual turmoil hits, all the bids disappear. There probably is no single cause for today’s plunge, other than down was the path of least resistance for the markets. HFT probably contributed to the plunge, and may have contributed to the recovery too.

Regardless of my opinions, today’s move is going to continue to chip away at the idea that the markets are fair, efficient, or even consistent.