Sat 1 Mar 2008

Now that Fidel Castro is stepping aside, it might be worth taking a look at the closed-end fund CUBA again. As we might expect, there was quite a pop on 2/19 when the news was announced — going from $7.50 to $9… about 20%.

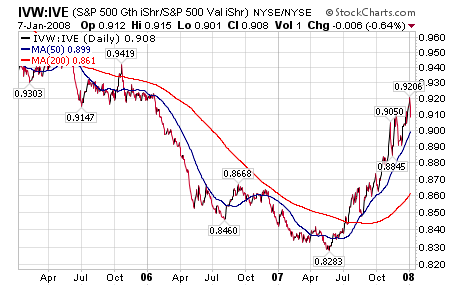

As a closed-end fund, it is worth taking a look at the discount/premium to NAV:

While the chart doesn’t show it (the last data point is Jan 08), the fund is currently trading at a 9.9% premium to NAV. The impressive thing is that the fund is back down off it’s 70%+ premium at it’s highest.

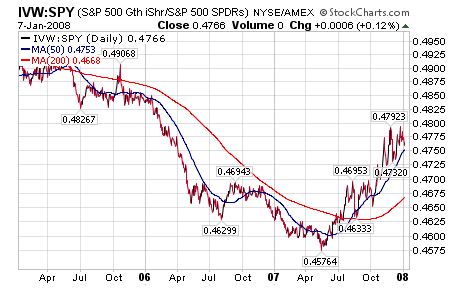

Even more telling is this 3 year chart…

As you can tell, when Fidel went into the hospital in August 06, it preceded a rather large spike in the share price of the ETF. Yes, the share price traded well over 70% above the NAV, but as a trader of the security, you have the advantage to sell at the market price regardless of the NAV. Also important, the volume spike this month was much higher than anything we saw back in 2006 or 2007.

Would I put money on the line with CUBA right now? If I could manage the risk to my satisfaction, I would certainly consider it. There is one significant difference between the end of 2006 and today… the overall market has gone from a bullish/happy/speculative mood into a more somber/worried/panicky mood. That alone warrants caution when considering going long on pure speculations like this.

Will Cuba (the country) benefit from Raul Castro being in control instead of Fidel? Probably not in the short term, but as we have all witnessed from time to time, markets have the ability to trade independently from the reality on the ground.