Tue 6 Mar 2007

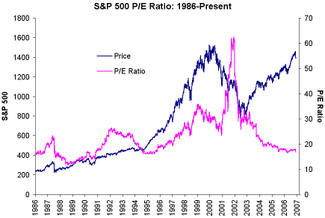

I found a good little blurb (and a good chart) on Ticker Sense regarding the S&P 500’s 5% decline and previous such declines…

With today’s near 1% decline, the S&P 500 is now down 5.86% form its peak on 2/20. This is the seventh time during this bull market that the S&P 500 has declined by 5% or more from a peak. In [the chart], we plot the S&P 500 highlighting each correction in red. The lower chart shows the percentage decline in each correction on a cumulative basis (from peak to trough).

On average, declines have lasted an average of 74 calendar days. Once the market does reach its low point, it has taken an average of 64 calendar days to recoup the losses.

While looking at historical patterns can mislead as easily as it can enlighten, it is worth noting that we’re not talking about a short-term one-week dip and one week recovery here.? With an average decline timeframe of 74 calendar days, we aren’t going to see the markets make new highs tomorrow if/when a recovery starts. (more…)