Wed 13 May 2009

Barry Ritholtz recently posted the following amusing anecdote:

In a small town on the South Coast of France, the holiday season is in full swing, but it is raining so there is not too much business taking place.

Everyone is heavily in debt.

Luckily, a rich Russian tourist arrives in the foyer of the small local hotel. He asks for a room and puts a Euro100 note on the reception counter, takes a key and goes to inspect the room located up the stairs on the third floor.

- The hotel owner takes the banknote in a hurry and rushes to his meat supplier to whom he owes E100.

- The butcher takes the money and races to his supplier to pay his debt.

- The wholesaler rushes to the farmer to pay E100 for pigs he purchased some time ago.

- The farmer triumphantly gives the E100 note to a local prostitute who gave him her services on credit.

- The prostitute quickly goes to the hotel, as she was owing the hotel for her hourly room used to entertain clients.

At that moment, the rich Russian comes down to reception and informs the hotel owner that the room is unsatisfactory and takes his E100 back and departs.

There was no profit or income. But everyone no longer has any debt and the small town?s people look optimistically towards their future.

Could this be the solution to the global financial crisis?

I was reminded of the posting when I read the following conclusion from Jeremy Grantham’s latest quarterly letter.

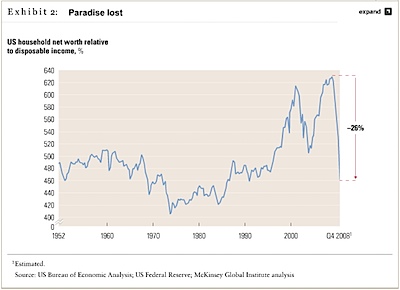

Let me [emphasize] once again the difference between real wealth and the real economy on one hand, and illusionary wealth and debt on the other. If we had let all the reckless bankers go out of business, we would not have blown up our houses or our factories, or carted off our machine tools to Russia, nor would we have machine gunned any of our educated workforce, even our bankers! When the smoke had cleared, those with money would have bought up the bankrupt assets at cents on the dollar and we would have had a sharp recovery in the economy. Moral hazard would have been crushed, lessons learned for a generation or two, and assets would be in stronger, more ef? cient hands. Debt is accounting, not reality. Real economies are much more resilient than they are given credit for. We allow ourselves to be terri? ed by the “?nancial-industrial complex” as Eisenhower might have said, much to their advantage.

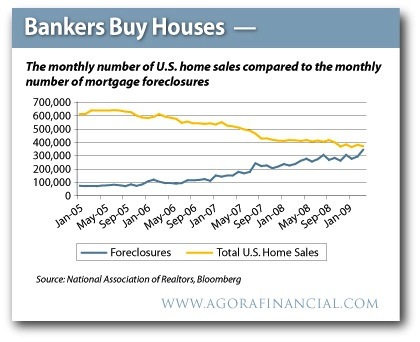

At the end of the day, the amount of debt destruction or deleveraging in the economy doesn’t change the underlying assets surrounding us. (Note that Grantham is talking about this in the aggregate, for the entire economy and country.) Illusions of wealth disappear, and ownership of those real assets often change hands… a fact that the “financial-industrial complex” is well aware of, and takes advantage of.